Wallstreetbets would be proud.

I was replying to my indexing rant/post. ![]()

No sarcasm intended.

Update:

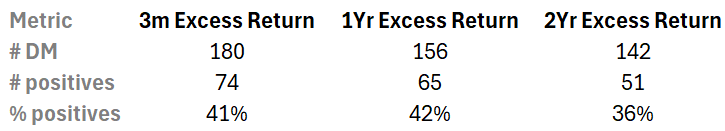

Slight improvement compared to the last reading. These periods seem to be more favorable for factor investing, but results are still well below 50%.

36% of users managed to beat the benchmark over the past two years. Please note that the benchmark may be mis-specified for some DMs.

Interestingly, current market value (total revenues) of DM's market is 5014 USD/month. With more enhancements it will be easily bigger .... by allowing users better compare DMs and restricting Designers to remove DMs that do not perform.

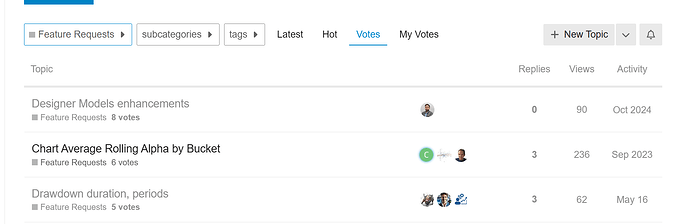

I’ve been waiting for the 10Y Return feature for quite some time. I believe it’s a three-hour job. Please vote: Designer Models enhancements

This is currently the top-voted request:

What happened here? ![]() (20% gain in one day)

(20% gain in one day)

The so-called lottery ticket has paid off – but that’s part of the game.

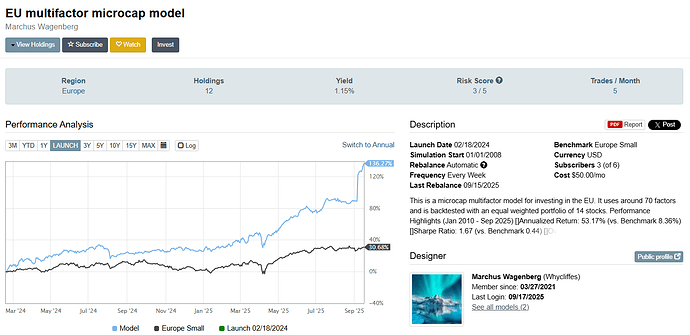

Congrats to Marchus, who is now the leader in the Europe segment! ![]()

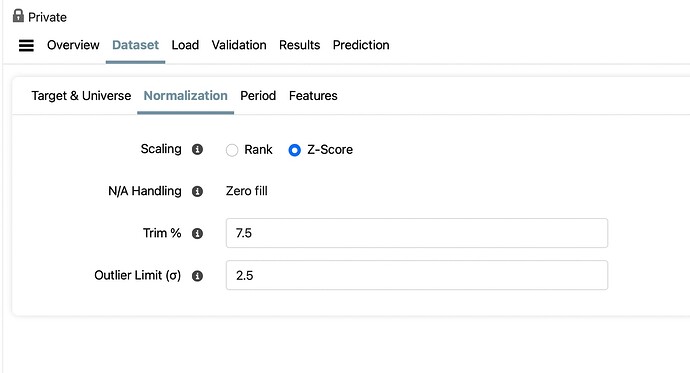

It is part of the game, I think. Makes me wonder how we should handle outliers. Outliers have a real impact in live models.

If the outlier is not an error in Factset’s data do we want to remove it at all? If so what is a good trim? We can change it, so what is a good trim for P123’s Z-score normalization?

If you use XGBoost is Huber loss a good way to handle outliers? Absolute deviations runs too slow for me. But do we even want to hide the effect of outliers if they are part of the game?

If we’re going to see outliers in real trading, shouldn’t we train on them — unless they’re truly one-off events?

Pretty sure I don’t know the best way to do it. but I think that data point would be removed in training if you used the default z-score normalization:

Congratulations on the strong performance ![]() ! @Whycliffes

! @Whycliffes

Really impressive to see how you’ve positioned yourself and captured that growth. I noticed you’re investing in Turkey — that’s not so common, since access through Interactive Brokers (IBKR) to Borsa İstanbul can be quite limited for most retail investors. Did you go through a local broker, or perhaps use ETFs/funds with Turkish exposure? Would love to hear your approach — it could be very insightful for others looking at emerging markets.

Hi, thanks. Yes, the system has done well and has captured most of the returns during a period when the portfolio was registered in EUR, and therefore I didn’t experience the change between EUR/ USD (12%). That said, even though I believe it is a good system, and I use most of the criteria in my own system, it is over a very long OUS-time that the systems will show their value.

But I chose to include Turkey because it seems that some have access to the market through IBKR, but I myself cannot trade there. However, I have done quite a few tests of the ranking system on other market compositions. Among others, the ones I trade in Europe, and the returns are not very different. I will publish that a bit later.

But take a look here: https://brokerchooser.com/turkey

We are revising the performance for this strategy. There was a 17% jump because there was a model revision that changed the currency from EUR to USD. This is not supported and should have given an error, but it got changed because the revision logic is not checking.

This means that the performance of this model is around 17% lower for this year. Still a very good model, but maybe not the leader? We’ll see. We’re in the middle of fixing the problem.

Also, we will disallow revisions that change currency in the future. Sorry about this.

The 1Y performance dropped from 90% to around 60% which means the model will lose its current #1 spot after tonight’s update.

Projected placement is 3rd depending on its performance and Yuval’s model performance today.

Good! I was also surprised by the sudden jump and tried last night to review which transactions could have caused it.

However, it should absolutely be permissible to change the currency cross.

This is because the model was originally set to EUR by mistake. Most of the other European designer models are set to USD and have benefited from the positive currency effect on their European strategy (13%). In addition, I think most of the platform’s users are based in the US or Canada.

I can, of course, restart the model with USD, but I really don’t like simply deleting older models and starting new ones. That has also been criticized many times here in the forum. It is better to improve and revise existing models and be transparent with those who choose to follow them.

The change of currency should never apply retroactively, as apparently may have happened here. It should only apply from the time of the revision.

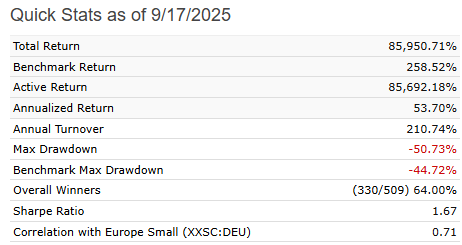

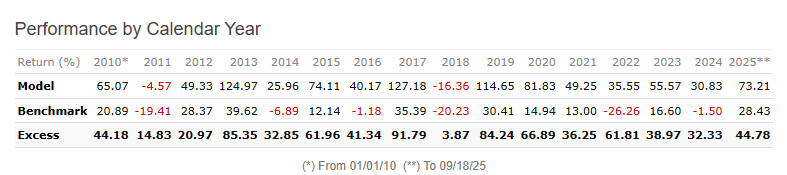

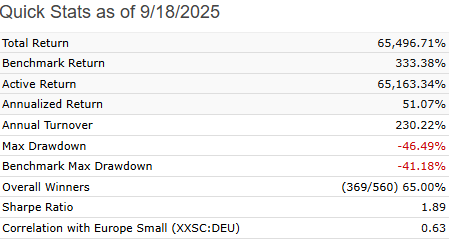

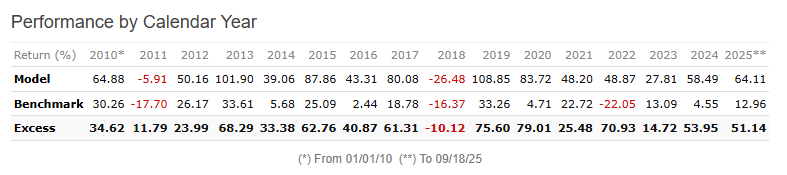

Thank you, and yes, this is a good European model for now, and after the revision, even without the currency effect, a very good—with an equally weighted positioning—European model. However, I believe these models provide very little overall guidance as to whether they are good or bad until much more time has passed. ![]()

Here are the two models compared.

USD Based:

Eur Based:

Thank you for clarifying this.

Therefore, congrats to Yuval, who remains the leader in the Europe segment!

@marco Could you also address the missing option to sort by ‘10yr Return’ in the main table?

Europe can be tricky ![]() . Some countries carry relatively high corruption indexes yet still manage to deliver strong CAGR. I recall Yuval writing something about corruption indexes in a post. What’s interesting is that many of these markets still meet the minimum average volume requirements — what I half-jokingly call the “ADR of Europe.” Some of them are fairly reliable, others less so.

. Some countries carry relatively high corruption indexes yet still manage to deliver strong CAGR. I recall Yuval writing something about corruption indexes in a post. What’s interesting is that many of these markets still meet the minimum average volume requirements — what I half-jokingly call the “ADR of Europe.” Some of them are fairly reliable, others less so.

Then you have places like Turkey (just improving in terms of corruption, anyway): harder to access, but potentially very profitable if you know how to navigate them.

My own approach is to match the country I invest in with its local currency. That way, I strip out FX noise and get a clearer view of how the stocks themselves are actually performing.

Anyway, each one must do the corresponding due diligence where want to be invested ![]()

Yes, I agree. I think the DM portfolios should have addressed this issue with currency crosses to a greater extent, and now with possible expansion into Asia on the horizon, this problem will become even more significant. Therefore, a solution where the DM portfolio subtracted currency gains or managed to match it against the local currency in the investment country would be great. ![]()

Currency was implemented as a read-only property across the platform due to technical constraints. Strategies and accounts are designed to support only a single currency position, so converting a model’s entire history to USD would be needed for it to function correctly. Preventing changes to currency when revising a Designer Model will align its behavior with the rest of the platform. (An internal tool which converts a strategy’s/account’s entire history exists, but it’s not something that has been exposed to clients.)