I see that this thread is filled with coders who appear to have a good understanding of Python ![]() I have been working for a while on something relatively simple: creating a system that allows for backtesting and viewing the latest signal from the Bold Asset Allocation, aggressive version. Bold Asset Allocation - Allocate Smartly

I have been working for a while on something relatively simple: creating a system that allows for backtesting and viewing the latest signal from the Bold Asset Allocation, aggressive version. Bold Asset Allocation - Allocate Smartly

It should be fairly straightforward, yet I am unable to get the returns to display correctly at all. This issue persists even when I tried to incorporate the combination from Jrinne's latest script.

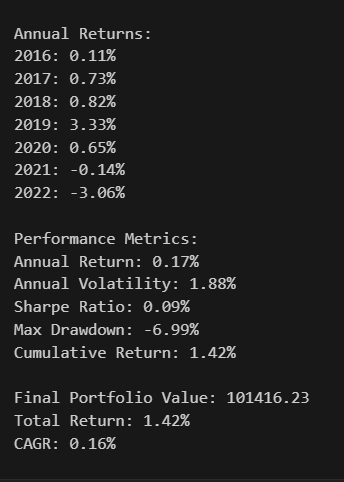

I don't understand why the returns are nowhere near the 11-12% since 2016. Is there anyone who can identify the error?

I see that attempts to resolve this have been made previously: Anyone know how to build these in P123 - #11 by Whycliffes

import backtrader as bt

import pandas as pd

import numpy as np

import yfinance as yf

from datetime import datetime, timedelta

import time

from collections import OrderedDict

import matplotlib.pyplot as plt

class KeyllyStrategy(bt.Strategy):

params = dict(

lookback_months=12,

defensive_allocation=1/3,

rebalance_threshold=0.01

)

def __init__(self):

self.canary = ['SPY', 'EFA', 'EEM', 'AGG']

self.offensive = ['QQQ']

self.defensive = ['AGG', 'LQD', 'PDBC']

self.safe = 'BIL'

self.start_date = self.datas[0].datetime.date(0)

self.end_date = self.datas[0].datetime.date(-1)

self.monthly_returns = OrderedDict()

current_date = pd.Timestamp(self.start_date)

while current_date <= pd.Timestamp(self.end_date):

self.monthly_returns[current_date.strftime('%Y-%m')] = (current_date.date(), None)

current_date += pd.offsets.MonthEnd(1)

self.annual_returns = {}

self.monthly_closes = {asset: [] for asset in self.canary + self.offensive + self.defensive + [self.safe]}

self.portfolio_start_value = self.broker.getvalue()

self.month_start_value = self.portfolio_start_value

self.year_start_value = self.portfolio_start_value

self.current_month = None

self.current_year = None

self.last_month = None

self.current_weights = {d._name: 0.0 for d in self.datas}

self.target_weights = {d._name: 0.0 for d in self.datas}

self.mode = 'defensive'

self.pending_orders = []

self.initialization_complete = False

# Enhanced tracking

self.portfolio_values = []

self.positions_history = []

self.daily_returns = []

def notify_order(self, order):

if order.status in [order.Completed]:

self.pending_orders.remove(order)

self.log(f"Order completed: {order.data._name}")

def log(self, txt, dt=None):

dt = dt or self.datas[0].datetime.date(0)

print(f'{dt.isoformat()} - {txt}')

def track_returns(self):

if not self.initialization_complete:

return

current_date = self.datas[0].datetime.date(0)

portfolio_value = sum(self.getposition(d).size * d.close[0] for d in self.datas)

cash = self.broker.getcash()

total_value = portfolio_value + cash

self.portfolio_values.append((current_date, total_value))

month_key = current_date.strftime('%Y-%m')

if self.current_month is None:

self.current_month = current_date.month

self.current_year = current_date.year

self.month_start_value = total_value

self.year_start_value = total_value

return

if self.is_last_trading_day_of_month(current_date):

monthly_return = ((total_value / self.month_start_value) - 1) * 100

self.monthly_returns[month_key] = (current_date, monthly_return)

self.month_start_value = total_value

if current_date.year != self.current_year:

annual_return = ((total_value / self.year_start_value) - 1) * 100

self.annual_returns[self.current_year] = annual_return

self.year_start_value = total_value

self.current_year = current_date.year

self.current_month = current_date.month

self.log(f"Month End Value: {total_value:.2f}, Return: {monthly_return:.2f}%")

def next(self):

current_date = self.datas[0].datetime.date(0)

if self.last_month != current_date.month:

for asset in self.monthly_closes:

data = self.get_data_by_name(asset)

if data:

self.monthly_closes[asset].append(data.close[0])

self.last_month = current_date.month

if len(self.monthly_closes['SPY']) < 13:

self.log("Building historical data...")

return

if not self.initialization_complete:

self.initialization_complete = True

self.month_start_value = self.broker.getvalue()

self.track_returns()

if not self.is_last_trading_day_of_month(current_date) or self.pending_orders:

return

canary_momentum = {asset: self.calculate_13612W_momentum(self.monthly_closes[asset])

for asset in self.canary}

self.log(f"Canary momentum: {canary_momentum}")

all_positive = all(mom > 0 for mom in canary_momentum.values())

self.target_weights = {d._name: 0.0 for d in self.datas}

portfolio_value = self.broker.getvalue()

if all_positive:

self.mode = 'offensive'

self.target_weights['QQQ'] = 1.0

self.log("Switching to offensive mode: 100% QQQ")

for data in self.datas:

if data._name == 'QQQ':

target_value = portfolio_value

target_size = target_value / data.close[0]

order = self.order_target_size(data, target_size)

self.pending_orders.append(order)

else:

self.mode = 'defensive'

defensive_scores = {asset: self.calculate_relative_momentum(self.monthly_closes[asset])

for asset in self.defensive}

sorted_assets = sorted(defensive_scores.items(), key=lambda x: x[1], reverse=True)

best_defensive = sorted_assets[0][0]

self.target_weights[best_defensive] = self.params.defensive_allocation

self.target_weights[self.safe] = 1 - self.params.defensive_allocation

self.log(f"Switching to defensive mode: {best_defensive}={self.params.defensive_allocation*100:.0f}%, {self.safe}={100-self.params.defensive_allocation*100:.0f}%")

for data in self.datas:

target_weight = self.target_weights[data._name]

if target_weight > 0:

target_value = portfolio_value * target_weight

target_size = target_value / data.close[0]

order = self.order_target_size(data, target_size)

self.pending_orders.append(order)

self.positions_history.append({

'date': current_date,

'mode': self.mode,

'weights': self.target_weights.copy()

})

def calculate_13612W_momentum(self, prices):

if len(prices) < 13:

return -np.inf

p0 = prices[-1]

p1 = prices[-2]

p3 = prices[-4]

p6 = prices[-7]

p12 = prices[-13]

return (12 * (p0/p1 - 1)) + (4 * (p0/p3 - 1)) + (2 * (p0/p6 - 1)) + (p0/p12 - 1)

def calculate_relative_momentum(self, prices):

if len(prices) < 13:

return -np.inf

return prices[-1] / np.mean(prices[-13:]) - 1

def get_data_by_name(self, name):

return next((d for d in self.datas if d._name == name), None)

def is_last_trading_day_of_month(self, dt):

current_date = pd.Timestamp(dt)

next_day = current_date + pd.Timedelta(days=1)

return current_date.month != next_day.month

def calculate_performance_metrics(self):

portfolio_df = pd.DataFrame(self.portfolio_values, columns=['Date', 'Value'])

portfolio_df.set_index('Date', inplace=True)

returns = portfolio_df['Value'].pct_change()

ann_return = (1 + returns).prod() ** (252/len(returns)) - 1

ann_vol = returns.std() * np.sqrt(252)

sharpe = ann_return / ann_vol if ann_vol != 0 else 0

cum_returns = (1 + returns).cumprod()

rolling_max = cum_returns.expanding().max()

drawdowns = (cum_returns - rolling_max) / rolling_max

return {

'Annual Return': ann_return * 100,

'Annual Volatility': ann_vol * 100,

'Sharpe Ratio': sharpe,

'Max Drawdown': drawdowns.min() * 100,

'Cumulative Return': (cum_returns.iloc[-1] - 1) * 100

}

def plot_results(self):

portfolio_df = pd.DataFrame(self.portfolio_values, columns=['Date', 'Value'])

portfolio_df.set_index('Date', inplace=True)

fig, ((ax1, ax2), (ax3, ax4)) = plt.subplots(2, 2, figsize=(20, 15))

# Plot 1: Cumulative Returns

returns = portfolio_df['Value'].pct_change()

cum_returns = (1 + returns).cumprod()

ax1.plot(cum_returns.index, (cum_returns - 1) * 100)

ax1.set_title('Cumulative Returns (%)')

ax1.grid(True)

# Plot 2: Drawdowns

rolling_max = cum_returns.expanding().max()

drawdowns = (cum_returns - rolling_max) / rolling_max * 100

ax2.fill_between(drawdowns.index, drawdowns, 0, color='red', alpha=0.3)

ax2.set_title('Drawdowns (%)')

ax2.grid(True)

# Plot 3: Monthly Returns

monthly_returns = pd.Series([ret for _, ret in self.monthly_returns.values() if ret is not None])

ax3.bar(range(len(monthly_returns)), monthly_returns)

ax3.set_title('Monthly Returns (%)')

ax3.grid(True)

# Plot 4: Strategy Mode

modes_df = pd.DataFrame(self.positions_history)

ax4.plot(modes_df['date'], [1 if mode == 'offensive' else 0 for mode in modes_df['mode']])

ax4.set_title('Strategy Mode (1=Offensive, 0=Defensive)')

ax4.grid(True)

plt.tight_layout()

plt.show()

def download_with_retry(ticker, start_date, end_date, max_retries=5):

for attempt in range(max_retries):

try:

buffer_start = start_date - timedelta(days=730)

buffer_end = end_date + timedelta(days=5)

df = yf.download(ticker, start=buffer_start, end=buffer_end,

progress=False, interval='1d', auto_adjust=True)

if not df.empty and len(df) > 100:

date_range = pd.date_range(start=start_date, end=end_date, freq='B')

df = df.reindex(date_range, method='ffill')

return df

time.sleep(2)

except Exception as e:

print(f"Retry {attempt + 1} for {ticker}")

time.sleep(2)

return None

if __name__ == '__main__':

cerebro = bt.Cerebro()

cerebro.addstrategy(KeyllyStrategy)

cerebro.broker.setcommission(commission=0.001)

cerebro.addobserver(bt.observers.Value)

cerebro.addobserver(bt.observers.Trades)

cerebro.addobserver(bt.observers.DrawDown)

tickers = ['SPY', 'EFA', 'EEM', 'AGG', 'QQQ', 'PDBC', 'BIL', 'LQD']

start_date = datetime(2015, 1, 1)

end_date = datetime(2023, 11, 16)

for ticker in tickers:

print(f"Downloading data for {ticker}...")

df = download_with_retry(ticker, start_date, end_date)

if df is not None and not df.empty:

data = bt.feeds.PandasData(dataname=df, fromdate=start_date, todate=end_date)

cerebro.adddata(data, name=ticker)

else:

print(f"Failed to load {ticker}")

exit(1)

start_cash = 100000

cerebro.broker.set_cash(start_cash)

cerebro.addsizer(bt.sizers.PercentSizer)

print(f"Starting Portfolio Value: {cerebro.broker.getvalue():.2f}")

results = cerebro.run()

strat = results[0]

print("\nMonthly Returns:")

for month_key, (date, ret) in sorted(strat.monthly_returns.items()):

if ret is not None:

print(f"{month_key}: {ret:.2f}%")

print("\nAnnual Returns:")

for year, ret in sorted(strat.annual_returns.items()):

print(f"{year}: {ret:.2f}%")

metrics = strat.calculate_performance_metrics()

print("\nPerformance Metrics:")

for metric, value in metrics.items():

print(f"{metric}: {value:.2f}%")

end_value = cerebro.broker.getvalue()

total_return = ((end_value - start_cash) / start_cash) * 100

years = (end_date - start_date).days / 365.25

cagr = ((end_value / start_cash) ** (1/years) - 1) * 100

print(f"\nFinal Portfolio Value: {end_value:.2f}")

print(f"Total Return: {total_return:.2f}%")

print(f"CAGR: {cagr:.2f}%")

strat.plot_results()

cerebro.plot(style='candlestick', volume=False)