That series starts mid-2018. Just sayin’

I got it to 20% using volatility lower is better, where these factors are about 3% of the total amount of factors (150) in the ranking system. My idea is that these stocks have a better chance of being ‘under the radar’.

Having said that, most of the stocks in the top ranks of the ranking system are still very volatile.

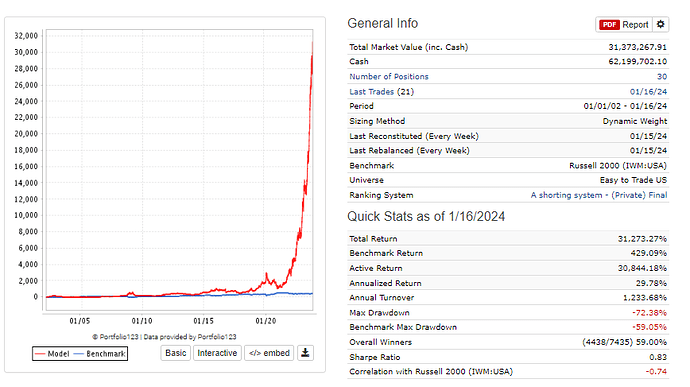

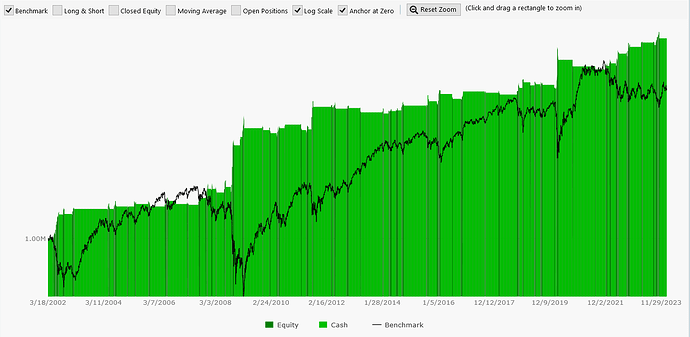

Running the RS as a shorting simulation with 30 stocks and 10% margin carry cost in the Easy to Trade US Universe, the system ends up with a 30% annualized return, which seems very attractive, especially because the returns occur in periods where markets (and my long systems) do not do so well.

I’m still hesitant to implement it in practice via a book though, as I am unsure about how to deal with short selling restrictions or the situation where lending costs in practice will be higher than 10% for some stocks, especially because I like trading via the account strategies section of portfolio123 with a link to IBKR.

That doesn’t even take into account yet that about 50 out of 10.000 transactions (1 in every 200 transactions) in the past 22 years had a return lower than -100%, the worst transaction did -600%. That would have been hard to stomach.

I could set up a seperate IBKR account specifically for trading put options by an amount equal to about 10% of the long stock portfolio. But this would mean that I would have to transfer money from one IBKR account to the other every now and then to keep the balance at 90 / 10. That seems like too much of a hastle.

I still need to think this through…

Do you guys get the lendings for putting on the short and if yes which broker do you use?

Victor,

Am I reading you right that while a short or puts system usually looks for the most volatile stocks, you got the 20% short return by reversing that node? If so, that seems entirely counterintuitive. What made you think about trying it, and what’s the rationale? I can’t get anywhere near 20%, but I’m not really trying, instead trying to get negative alpha for top-ranked stocks with much longer holding periods over the last ten years (I use the rolling screen for testing rather than the rank performance) . . . But when I ran my ranking system after reversing my volatility node, my performance on this measure certainly did improve! What is going on here? If I optimize for long-term negative alpha, high volatility is my number-one node.

BTW, what does 20% in “transaction type: short” convert to if you use transaction type: long and reverse the ranking system direction? Does reversing the volatility node have the same effect if you do it that way?

I already managed to get 20% returns on Easy to Trade US (for what that’s worth) before inverting the node.

The reason for inverting the node was to see if I could make a ranking system that was less reliant on high price volatility. I don’t like reliance on any one factor. As you have written yourself (if I remember correctly), price volatility is likely a proxy for other ‘volatilities’ , so I try to look for factors that capture that volatility. Apart from that, with Black-Scholes being so main stream, I’m betting that other investors will also be comparing historical price volatility to implied volatility. Of course, price volatility is known to be pretty persistent, so if you look for highly volatile stocks, then more likely than not, they will stay highly volatile. But if we can find other factors that are predictive of riskiness, we might be able to buy put options that have low price volatility while in fact they are quite risky (and probably those put options will be relatively cheap).

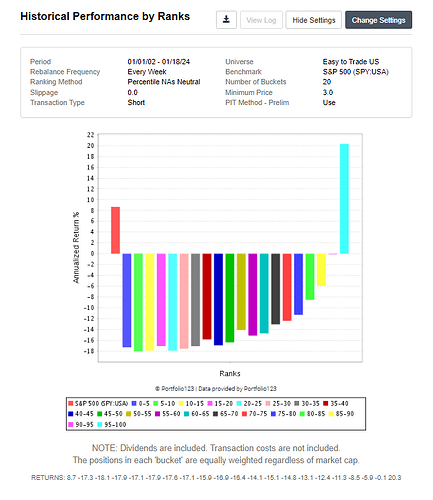

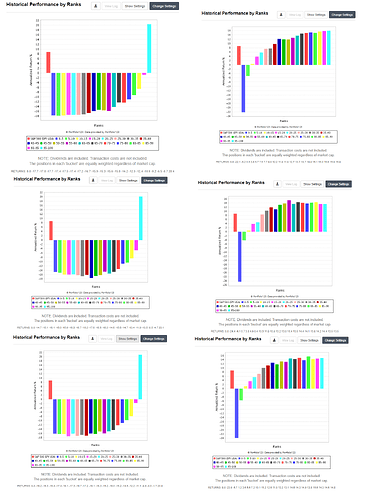

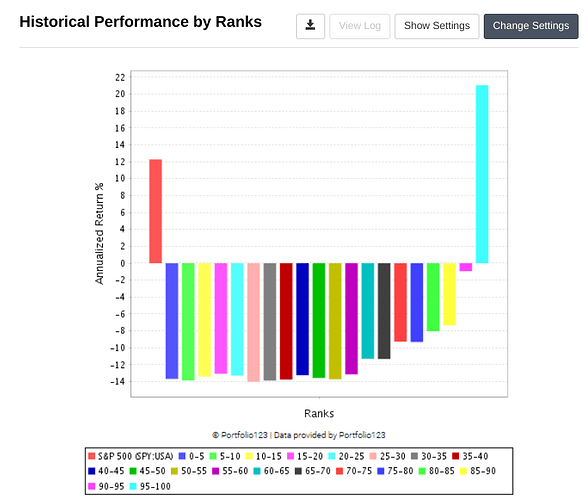

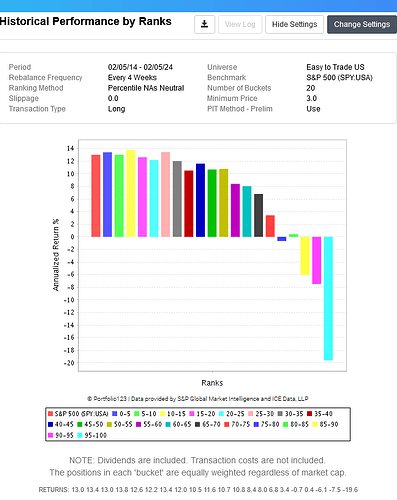

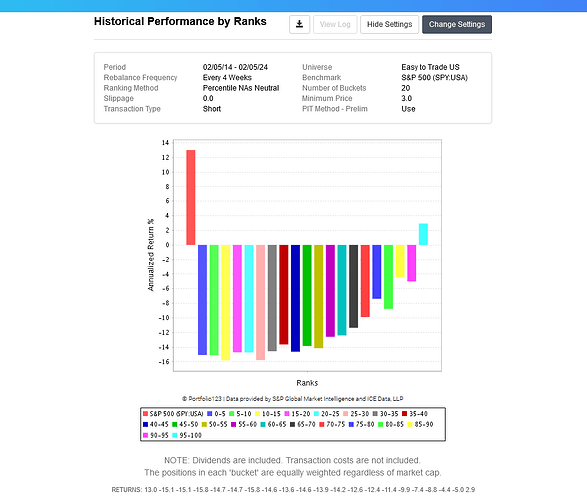

Below are the results for the ranking systems, where there first row is with volatility lower is better, the second is higher is better and the last one is without the node. From that I get the impression that the short system is not so reliant anymore on this one factor (results are the same when splitting the universe in 5 subsamples).

Thanks Victor for all your help; your ideas really helped me build a short only strategy. I’m still using a bit of weight into Price Volatility but it is by far not my highest weight. I took a different approach where I just hit RS of 21. I focused on the most uncorrelated factors with uncertainty (35 total) as IMHO I’ve seen noise and curve fitting be introduced when I add correlated factors. The more noise and nodes I added were detrimental to my overall strategy. The short strategy now performs reasonably against other universes and larger number of entries. Thank you for your help!

I don’t understand how you’re getting those charts. When I run long I get this:

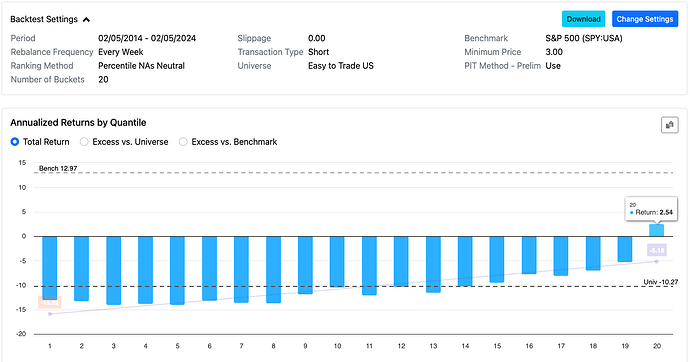

But when I run it short I get this:

To be honest, I do not understand the Portfolio123 methodology good enough to understand why inverting the ranking system (i.e. going from long to short and from higher is better to lower is better) does not result in inverting the results too.

I saw that @feldy had a comment on this (below). If you understand it better Feldy, could you perhaps elaborate further? Will for example focussing on improving the ‘worst’ bucket within a ‘long’ ranking system result in significantly different outcomes out of sample compared to improving the ‘best’ bucket in a ‘short’ ranking system?

Yuval, what ranking system are you testing there? Is it public? Are you trying to reconcile the per-bucket long performance vs the negated per-bucket short performance?

Victor, you’re not going to be able realistically trade that system based on that snapshot. Those very low MktCaps caught my eye, so I cross-referenced the IBKR borrow fees and shortable shares as of 01-12-2024 when you posted them.

| Symbol | MktCap | BorrowFee | ShortableShares | |

|---|---|---|---|---|

| 1 | ADTX | 2 | 390.11% | 15000 |

| 2 | AEON | 262 | 74.22% | 10000 |

| 3 | ALUR | 104 | 13.75% | 150000 |

| 4 | APLD | 830 | 1.57% | 300000 |

| 5 | ASTI | 0 | 133.49% | 100000 |

| 6 | ATLX | 290 | 13.87% | 150000 |

| 7 | BLFS | 753 | 0.31% | 800000 |

| 8 | CANO | 10 | 40.24% | 20000 |

| 9 | CAPR | 119 | 0.45% | 650000 |

| 10 | CBUS | 308 | 16.14% | 25000 |

| 11 | CING | 6 | 732.31% | 4000 |

| 12 | DBGI | 2 | 164.62% | 20000 |

| 13 | GMBL | 0 | 20.53% | 8000 |

| 14 | HSDT | 5 | 123.82% | 25000 |

| 15 | LIFW | 21 | 187.46% | 45000 |

| 16 | LTRY | 7 | 97.52% | 35000 |

| 17 | MTAL | 556 | nan% | 0 |

| 18 | NWTN | 1968 | 142.94% | 550000 |

| 19 | OCEA | 21 | 25.20% | 30000 |

| 20 | OMEX | 93 | 4.76% | 1100000 |

| 21 | PAVM | 27 | 1.70% | 20000 |

| 22 | SCLX | 181 | 37.22% | 300000 |

| 23 | SIDU | 8 | 953.11% | 100 |

| 24 | SMTI | 331 | 0.90% | 100000 |

| 25 | SYTA | 8 | 95.55% | 20000 |

| 26 | TMCI | 801 | 0.46% | 1800000 |

| 27 | TRML | 128 | 17.44% | 150000 |

| 28 | TTOO | 18 | 83.95% | 7000 |

| 29 | XOMA | 238 | 0.86% | 100000 |

You will need something like a MktCap constraint to keep things viable even if its imperfect. You may also want to exclude ADRs like NWTN that have high market caps but may still have high borrow fees.

For me, short selling no-revenue, small, and mostly biotech stocks is a recipe for disaster when risk is off and junk is on. There may be even no liquidity in the book when you need to cover your short. I could not sleep well… ![]()

I’m using more or less the factors provided in this post, and testing short system using puts. I found that the stocks in my portfolio are super correlated with each other, either all stocks go up or go down.

However, this is probably the only way to gain positive return in long term.

In addition, I sell short-dated, ~0.2 delta ES puts. This is the region where volatility risk premia has been historically the highest.

This is my universe I use for trading puts:

https://www.portfolio123.com/app/universe/summary/290776

It follows more or less CBOE regulations.

Pitmaster,

Just a thought. I have papertraded a pairs strategy and took one Coursera course on this. So exactly no real experience with this and I know my limitations.

But you want the shorts to be correlated to the longs perhaps (and not so much to each other)?

Pairs traders use cointegration as I am sure you already know. And you probably have the expertise to develop a Python program to loop through all of the combinations of longs and shorts using the cointegration formulas. I am not sure I could do that so i will not suggest it here.

But from the Coursera course, many would use hierarchical clustering–which I know you can do with a Python library(Clustering in Sklearn)—matching stocks close to each other in the dendrogram. At least as an initial screen.

As you know the correlation distance for hierarchical clustering is simply: Correlation distance=1−r

In real-time you could draw the dendrogram and get a visual understanding of what stocks to pair with your longs.

In words, the Python algorithm would take the highest ranked stock (for the long position) and use a loop to find the stock with the largest correlation (or smallest correlation distance) in the bottom quantile of the ranking system (e.i., in lowest bucket). Loop through all of the long positions purchase at rebalance. Buy the long and short the other stock found in your loop. Sell both when your long port sells the long position.

I think I could do this in Python (and get the returns) so I know you could. And again, in real time you could do it with a dendrogram.

Just a thought for now. But something I will certainly try when I start using shorts or options. If (and only if) members found this useful thought experience, P123 could do a dendrogram: not a feature suggestion.

This is different or adds to classic pairs trading as it uses P123 to select long stocks. Pairs trading focuses more on relative price movements. So maybe call it an optimally correlated (or inversely correlated when using shorts) hedge. But not pairs trading exactly. Is there any simpler way to gat an inversely correlated hedge to reduce drawdowns?

Jim

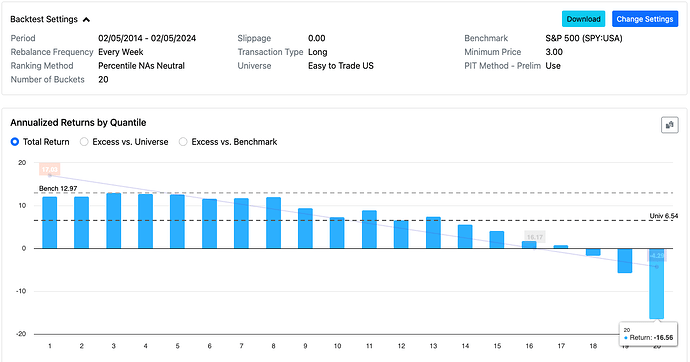

No, it’s the ranking system I use to buy put options. I’m trying to reconcile the right-most bucket of the ranking system (around -20% return) with the right-most bucket of exactly the same ranking system but using the “short” button instead of the “long” button (about 3% return). And I’m wondering how anyone can get 20% using the “short” button. At this proportion, that would mean getting -130% using the “long” button.

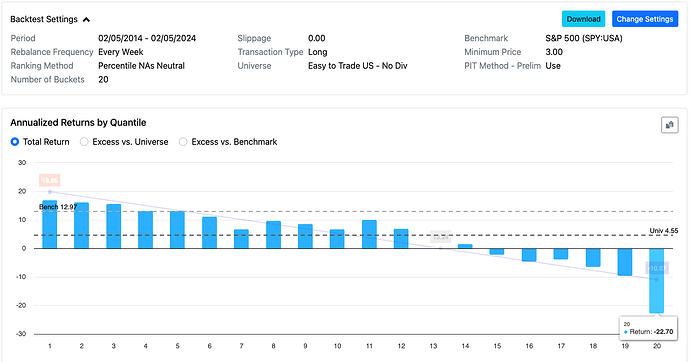

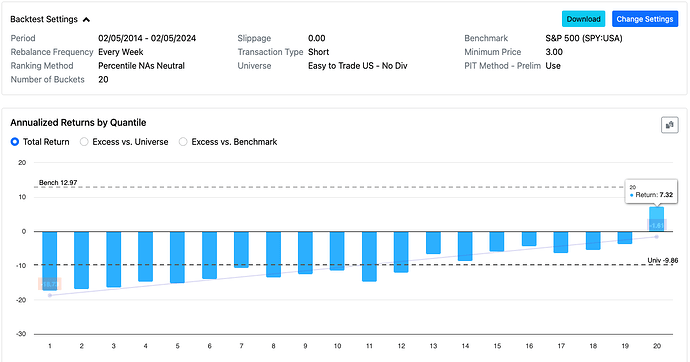

Hmm, I ran a test to try to isolate the effect of dividends on the performance of the right-most bucket when switching between long and short in the rank performance. Using Victor’s public shorting system, I ran a long and short rank performance on the Easy to Trade US universe. I then ran the same comparison on a custom Easy to Trade US No Dividend universe.

Even for the no dividends universe, I still see a large discrepancy between the long performance of the top bucket and the inverse of the short performance of the top bucket, so there must be some other factors at play.

@yuvaltaylor, can you check with the p123 developers to see if there’s a carry cost that’s hard-coded when you run with transaction type set to short? There’s no parameter exposed, but there must be something going on under the hood.

Long - Easy to Trade US

Short - Easy to Trade US

Long - Easy to Trade US No Dividends

Short - Easy to Trade US No Dividends

Aaron explained it to me. It’s the compounding effect. Two periods of a 10% gain compound to 21%. Two periods of a 10% loss compound to -19%. There’s no carry cost involved.

Hi, I have some questions,

Do you reduce short positions when it get bigger due to losses ?

I developed a good system that work well on screener and I want apply it to a (live) simulated strategy. However, I want to have my position equal weighted after each rebalancing.

I do not have access to dynamic weighting. Is there any option to have my position equal weighted w/o dynamic weighting ? or to reduce my positions that are far too big from ideal size ?

Yes, it’s possible to accomplish this with Weight or a combination of Eval and Weight. You could add a rule like “Weight > 20” to exit a position if it exceeds 20% of the portfolio value, and set “Allow Immediate Buyback” to Yes to allow the buy rules to repurchase.

An even more precise solution is to use Eval with Weight to specify how much of the position you want to sell. This usage is well documented in the factor reference for Eval:

To trim a position that gets too large in a Portfolio

SELL rules sell a position when any of the rules evaluates to TRUE, or 1. But a little known feature allows you to sell a portion of a position if a rule evaluates to a number between 0 and 1.0. For example to sell half a position if the weight exceeds 30% of the portfolio, and do nothing otherwise, enter the following SELL rule:

Eval(Weight>30, 0.5, 0)

This may do what you want. I made a few edits from my original form, hopefully it still works as intended. Of course, replace the condition part of Eval with what you want. You’ll probably want to condition it with Weight>@ReBalTarget.

!SetVar(@ReBalTarget,10) // Ideal position weight is 10% of port value

!SetVar(@ReBal,@ReBalTarget/Weight) // Calculate portion that represents target

eval(Weight>@ReBalTarget*1.50,1-@ReBal,0) // trigger sell when position is 150% over @ReBalTarget