Interesting paper. I took it for a quick spin.

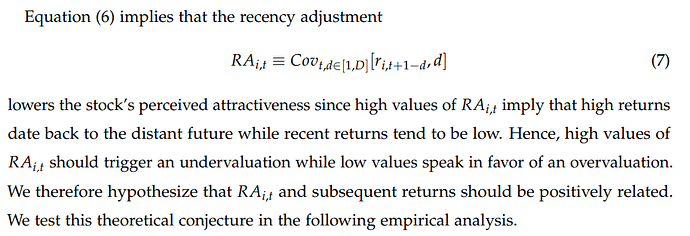

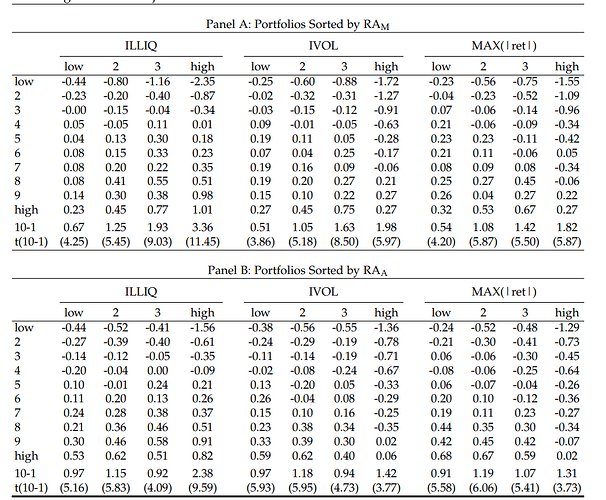

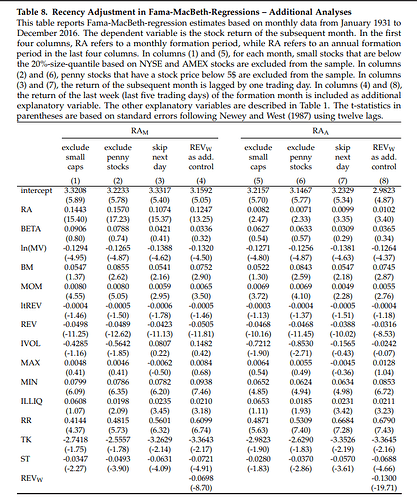

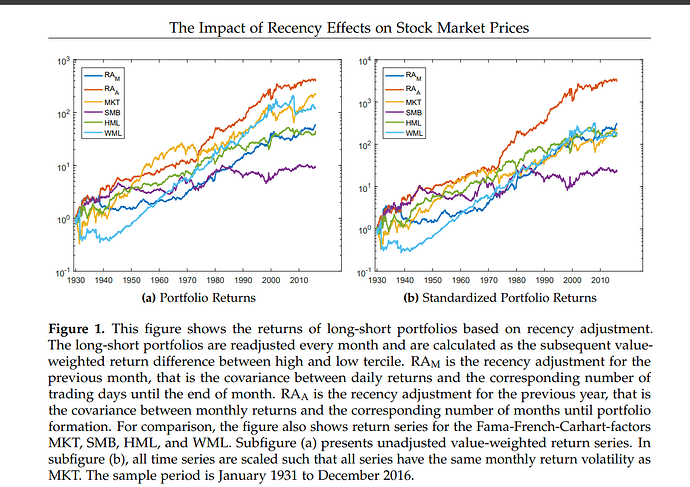

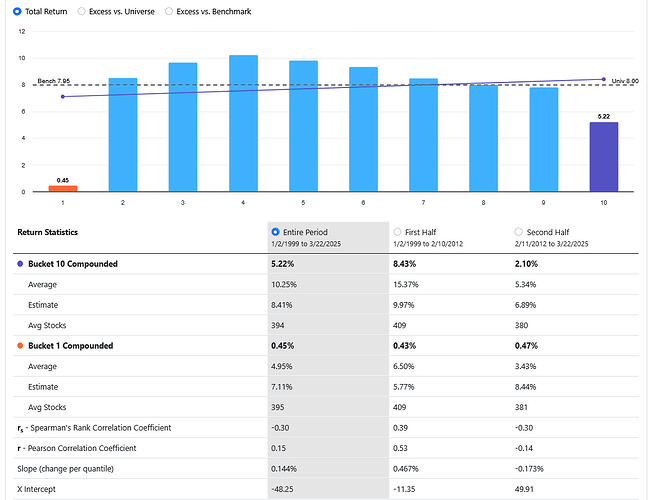

I believe the formula for RAsubM would be loopsum("(close(ctr)/close(ctr+1)-loopavg(`close(ctr)/close(ctr+1)`,21))*(ctr-10.5)",21)/21. Running this on the Easy to Trade US universe with Compustat data from 1999 to today with 4-week rebalancing gives a pretty mediocre result:

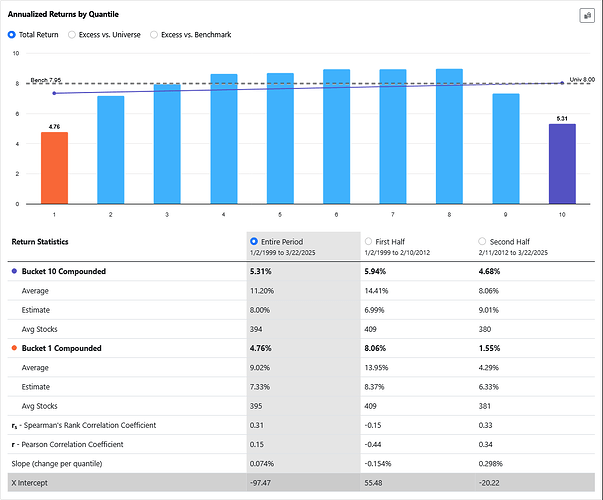

The results are about the same for RAsubA, using the formula loopsum("(close(ctr)/close(ctr+21)-loopavg(`close(ctr)/close(ctr+21)`,12,0,21))*(ctr-126)",12,0,21)/12

Of course, I may have gotten the formula wrong . . .

The formula calculates the covariance between the stock's rate of change and time

Your formula doesn't quite equal that, but it does rankings-wise mean the same thing.

It does seem like it's not working.

I remembered that I seem to have actually run a similar test before and just forgot about this one because its not fruitful.