Whichever broker actually does better, a VWAP order is a great opportunity for the broker and possibly for a P123 member.

Above, there is a discussion about the study and the smaller order size used in the study. Even a very large VWAP order will be broken up into smaller orders throughout the day. Often into 100 lot orders if I recall (I tend to use percent-of-volume orders now and I have not looked at the individual trade size). So it is not entirely clear that order size is a consideration for determining which broker has a better VWAP order. The study may be pertinent no matter how large your total VWAP order may be.

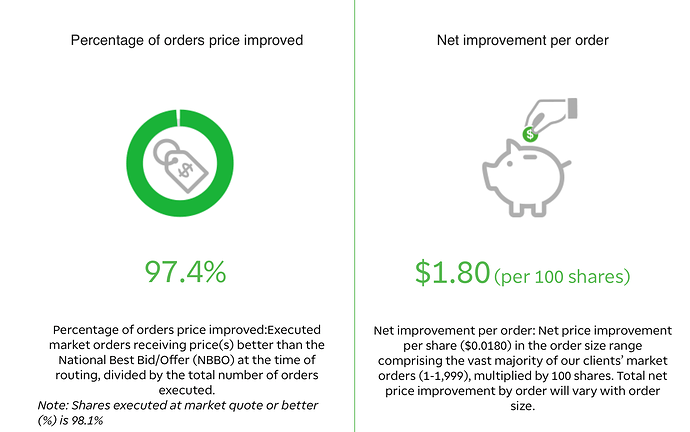

At IB, there is the potential for a rebate for being a market-maker on some of those trades, I believe. IB may share some of that rebate with you at times. You may find that IB is the better broker for you, in part because of that.

Presumably other brokers can get a rebate for being a market maker when executing market-maker trades through these exchanges. It is interesting that this does not count as payment-for-order flow it seems.

I have taken the time to look at some of the individual orders at Fidelity (a while ago) and there is order-price-improvement of some of the the individual VWAP orders going through at Fidelity. But it is difficult to quantitate how much total improvement one gets by the end of the day.

VWAP orders would present an opportunity for regular members who do not have computers that can execute tens of thousands of simultaneous orders with multiple brokers (as is done in the study above). The VWAP orders do that randomly (but not simultaneously) throughout the day for you. About 30 VWAP trades with 2 different brokers would be more trades than you would need to reach a conclusion.

So you can find your own definitive answer if you are investing enough for this to matter to you. There is no good reason for you to listen to any of my BS (or anyone else’s).

As far as real data that I have generated myself, I compared Folio Investing to Fidelity (with market orders) before I switched to Fidelity—alternating which broker I placed an order with first (at about the same time). Fidelity won by a huge margin. There was basically no order-price-improvement at Folio Investing for market orders when I looked a this.

My main takeaway from my little study: the difference can be huge which I think confirms what the paper said: there can be an order of magnitude (10X) difference according to the paper. Hmmmm……I think I am going to do a little more than say: “broker X has a lot of customers (and kind of a mystique), so I will use them.”

If anyone does the above study with VWAP trades and wants to share it, please include the commissions as well as any rebates.