Nice! Thanks!

- (Stop button) and and 5 are very useful features

Dear all,

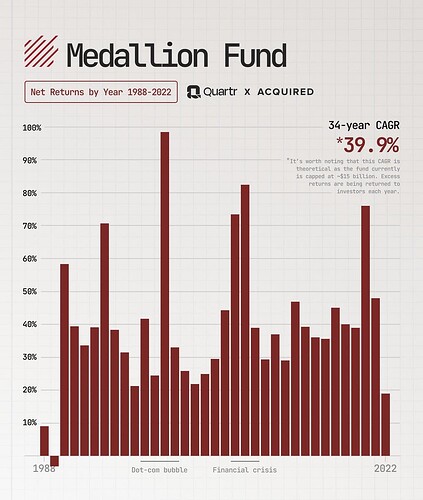

Visualizing the Medallion Fund's net returns by year since inception (1988-2022)

Regards

James

| Berkshire Hathaway | S&P 500 | Medallion (after fees) | Medallion (before fees) | |

|---|---|---|---|---|

| 1988 | 59.30% | 16.60% | 9.00% | 17.65% |

| 1989 | 84.60% | 31.70% | -4.00% | -2.04% |

| 1990 | -23.10% | -3.10% | 55.00% | 107.84% |

| 1991 | 35.60% | 30.50% | 39.40% | 77.25% |

| 1992 | 29.80% | 7.60% | 33.60% | 65.88% |

| 1993 | 38.90% | 10.10% | 39.10% | 76.67% |

| 1994 | 25.00% | 1.30% | 70.70% | 138.63% |

| 1995 | 57.40% | 37.60% | 38.30% | 75.10% |

| 1996 | 6.50% | 23.00% | 31.50% | 61.76% |

| 1997 | 34.90% | 33.40% | 21.20% | 41.57% |

| 1998 | 52.20% | 28.60% | 41.70% | 81.76% |

| 1999 | -19.90% | 21.00% | 24.50% | 48.04% |

| 2000 | 26.60% | -9.10% | 98.50% | 193.14% |

| 2001 | 6.50% | -11.90% | 33.00% | 64.71% |

| 2002 | -3.80% | -22.10% | 25.80% | 50.59% |

| 2003 | 15.80% | 28.70% | 21.90% | 42.94% |

| 2004 | 4.30% | 10.90% | 24.90% | 48.82% |

| 2005 | 0.80% | 4.90% | 29.50% | 57.84% |

| 2006 | 24.10% | 15.80% | 44.30% | 86.86% |

| 2007 | 28.70% | 5.50% | 73.70% | 144.51% |

| 2008 | -31.80% | -37.00% | 82.40% | 161.57% |

| 2009 | 2.70% | 26.50% | 39.00% | 76.47% |

| 2010 | 21.40% | 15.10% | 29.40% | 57.65% |

| 2011 | -4.70% | 2.10% | 37.00% | 72.55% |

| 2012 | 16.80% | 16.00% | 29.00% | 56.86% |

| 2013 | 32.70% | 32.40% | 46.90% | 91.96% |

| 2014 | 27.00% | 13.70% | 39.20% | 76.86% |

| 2015 | -12.50% | 1.40% | 36.00% | 70.59% |

| 2016 | 23.40% | 12.00% | 35.60% | 69.80% |

| 2017 | 21.90% | 21.80% | 45.00% | 88.24% |

| 2018 | 2.80% | -4.40% | 40.00% | 78.43% |

| 2019 | 11.00% | 31.00% | 39.00% | 76.47% |

| 2020 | 2.40% | 18.40% | 76.00% | 149.02% |

| 2021 | 29.80% | 28.70% | 48.00% | 94.12% |

| 2022 | 4.00% | -18.10% | 19.00% | 37.25% |

| 30 years Annualized | 11.85% | 9.29% | 39.30% | 75.66% |

| 20 years Annualized | 8.96% | 8.41% | 39.47% | 76.05% |

| 10 years Annualized | 10.18% | 9.41% | 36.50% | 69.99% |

| 5 years Annualized | 8.94% | 10.33% | 33.93% | 63.57% |

Renaissance Technologies: The Highest-Performing Investment Firm in History

16 minutes reading time

Published 21 Mar 2024

Author: Kasper Karlsson

Reviewed by: Peter Westberg

Imagine you’re fresh out of college in the late 1980s. You’ve been increasingly thinking about your financial future. Pondering whether to put your saved up money in stocks, some fund, or just keep piling them up in a savings account. Then one day, news reaches you that a mathematician you’ve heard great things about is setting up a fund. It’s Oswald Veblen Prize-winner James “Jim” Simons, and the fund is called The Medallion fund, under the umbrella of his company – Renaissance Technologies. You decide to invest $1,000, and 34 years later, the fund is not only reputed as the highest performing funds ever; your initial $1,000 investment is worth $90.1 million (if you’d been allowed to stay invested that is). This is in many regards an unprecedented success story, so let’s examine it a bit more thoroughly.

Key Insights

- Collaborative genius: The success of Renaissance Technologies, particularly the Medallion Fund, underscores the power of combining diverse expertise. With Jim Simons leveraging the very best out of people like Elwyn Berlekamp, Bob Mercer, and Peter Brown.

- Quantitative revolution: Their work exemplifies the shift in investment strategies towards quantitative, algorithm-based methods. By prioritizing data and statistical analysis over traditional investment approaches, unparalleled success was achieved.

- Secrecy and success: The Medallion fund’s legendary status is bolstered by its secretive yet extraordinarily profitable trading strategies. This mystique, combined with consistent high returns, contributes to its allure and the overall reputation of Renaissance Technologies.

- Impactful leadership: The transitions in leadership, from Simons to Mercer and Brown, and now Brown alone, highlight the impact of visionary leaders who can adapt and maintain a firm’s success over time.

The Origins of Renaissance Technologies

Renaissance Technologies, often just referred to as RenTec, is reputed as the highest-performing investment firms ever, with its Medallion Fund having returned a net 90,129x to investors between the years 1988-2022 leveraging a quantitative investment approach. Think of it as the financial world’s version of Moneyball, where instead of scouts and managers making decisions based on intuition, they rely on data, statistics, and algorithms. But before we dig deeper, and in order to understand RenTec, let’s briefly make ourselves familiar with the man behind it all – Jim Simons, and his career leading up to starting the company.

Born 1938 in Brookline, Massachusetts, Simon’s displayed an early affinity for mathematics, leading him to earn his bachelor’s degree from MIT and a Ph.D. from Berkeley by the age of 23. His academic path would eventually lead him into the fields of geometry and topology, where he left a lasting impact on both mathematics and physics with his work on the Chern-Simons form among other things. Before venturing into finance, Simons honed his code-breaking skills with the National Security Agency. There, he and his fellow researchers had the job of identifying patterns in huge amounts of data, and with the group’s credo of “bad ideas are good, good ideas are terrific, no ideas are terrible,” they could work on what they believed will generate most value, something Simons later would bring into the world of finance. He then moved on to academia, eventually becoming the chair of the math department at Stony Brook University.

Then, in a Long Island strip mall back in 1978, RenTec was founded, originally under the name Monometrics. The initial focus was on trading currencies, but it wasn’t long before Simons, intrigued by the mathematical patterns in the financial markets, began shifting the firm’s focus towards quantitative trading, leveraging complex algorithms and models to predict market movements. The firm was renamed Renaissance Technologies in 1982, marking a new era where it began intensifying its quantitative research, bringing aboard talented scientists and mathematicians.

The RenTec approach can be briefly described as focusing on non-random price movements and employing a multitude of PhDs from scientific disciplines, setting it apart from traditional investment forms. Its emphasis on, and success in algorithmic trading has not only made it a powerhouse in the hedge fund industry but also a pivotal figure in the evolution of financial trading, where data and algorithms have come to play an increasingly central role.

The Medallion Fund

The Medallion Fund, launched in 1988, is what RenTec is best known for (the visual below might make you understand why). This fund, since 1993 only available to RenTec’s employees and their families, has achieved legendary status due to its extraordinary returns. It’s returned on average – net – 39.9% to investors since 1988, significantly outperforming the S&P 500’s 10.7% during the same timeframe and becoming one of the best performing funds in history. It’s worth noting, however, that this CAGR number is a highly theoretical exercise. Having the fund capped at around $15 billion and distributing the excess to investors each year are important factors to take into consideration. Achieving these returns – at scale – would likely prove itself very challenging.

The strategies behind Medallion’s success are closely guarded, contributing to the overall mystique and allure of RenTec. A key enabler for the success of the Medallion Fund however, is Elwyn Berlekamp. He originally came from a well-rounded academic background including a bachelor’s degree, a master’s degree, and a Ph.D. in Electrical Engineering from MIT. And after a period of profound contributions to mathematics and coding theory, where he developed algorithms crucial for error-correcting codes, later recognized for their application in various fields including secure communications and data storage solutions, he was ready for something else. Leading him to RenTec.

He was put in charge of the Medallion Fund in 1989, and later in the same year, a new trading system was launched with an initial $27 million invested. His strategies were rooted in a deep understanding of probability, information theory, and the Kelly criterion – a method for determining the optimal size of a series of bets to maximize the expected value of the logarithm of wealth. Essentially telling you how much money to bet each time you play, so you can win the most money over many games without going broke.

Berlekamp eventually started pushing for shorter-term trades, and rewrote the algorithms to trade short term patterns with sizing as stated based on the Kelly criterion. This led to the fund’s first real success, achieving a 59% net return in 1989. And ever since, excluding the year 2022 and its 18% return, the fund has consistently returned over 20%, contributing to the (theoretical yet great for perspective) 34-year CAGR of 39.9%. Here’s the graph, visualizing Medallion’s net returns by year since 1988.

Robert “Bob” Mercer and Peter Brown

Speaking of RenTec and the Medallion Fund, the duo of Bob Mercer and Peter Brown simply can’t pass unmentioned. Mercer and Brown are two figures whose tenure at RenTec significantly shaped the firm’s trajectory, particularly concerning the legendary Medallion Fund. Their journey at RenTec began after Jim Simons lured them away from IBM in 1993 with an offer to double their salaries. At IBM, they were part of a pioneering group working on speech recognition technology, leveraging hidden Markov models and the Baum-Welch algorithm, which interestingly connects back to Simons’s early trading partner, Lenny Baum.

Once at RenTec, Mercer and Brown were highly involved in implementing a new trading system that integrated all the firm’s trading signals and portfolio requirements. This system was a leap forward for the firm, marking the beginning of a period of exceptional performance. While the exact details are closely guarded, it’s understood that the strategies involved statistical arbitrage, high-frequency trading (HFT), and pattern recognition. The system relied on a methodology that didn’t seek to understand the “why” behind market movements but rather focused on the “what” – identifying patterns that historically led to profitable outcomes. Here’s Bob Mercer on the power of tilting the probability to your favor and intensely executing on your strategy:

“We’re right 50.75% of the time [...] but we’re 100% right 50.75% of the time, you can make billions that way.”

Their innovations and leadership earned them promotions to senior managers and partners, eventually leading them to the roles of co-CEOs in 2010, following Simons’s step back from day-to-day operations. Then Peter Brown, after Mercer’s resignation in 2017, took over as the sole CEO, continuing to steer RenTec to this day. Their contributions, particularly in developing and enhancing the firm’s trading strategies, solidified its position as a powerhouse in the investment firm industry.

How Medallion “Solved the Market” According to Gregory Zuckerman and Peter Brown

In his book, “The Man who Solved the Market,” Gregory Zuckerman lays out the journey of Jim Simons from academia to the financial markets. He also goes into great detail of the Medallion Fund, and presents one of the very few available insights into the fund’s remarkable success. Here are some aspects that, according to Zuckerman, made it possible:

- Curated data: They were one of the first to collect and analyze data on basically everything – big as small – that even in the tiniest way could affect asset prices.

- AI and ML: Just having the data wasn’t enough. RenTec were also early adopters of building machine learning and AI models on top of their data.

- Position sizing: They trust the data and bet heavily when the odds are in their favor.

- The people: One of Simons’s most important talents was finding and recruiting math and physics PhDs that were creative problem solvers. Using the idea from his time at the IDA, of looking for the smartest, most creative types, instead of searching for people to fill specific skills.

- Use of Leverage: Zuckerman estimates that the Medallion Fund, on average, leverages its trades with 12.5x, sometimes even taking it to 20x when the data suggests doing so.

Another highly exclusive inside-look into RenTec is Goldman Sachs Exchanges’ podcast episode with Peter Brown. The now-CEO shares five of the principles followed by RenTec which are: science, collaboration, infrastructure, no interference, and time. @HiddenValueGems did a good job in collecting quotes on these principles from Brown in the episode, some of which we couldn’t avoid sharing here:

- Science: “The company was founded by scientists. It’s owned by scientists. It’s run by scientists. We employ scientists. We take a scientific approach to investing and treat the entire problem as a giant problem in mathematics.”

- Collaboration: “Science is best done through collaboration. If you go to a physics department, it would be absurd to imagine that the scientist in one office doesn’t speak to the scientist in the office next door about what he or she is working on. So, we strongly encourage collaboration between our scientists. For example, we encourage people to work in teams. We constantly change those teams up so that people get to know others within the firm.”

- Infrastructure: “We want our scientists to be as productive as possible. And that means providing them with the best infrastructure money can buy. Back at IBM I knew that some programmers were, like, ten times or more productive than others.

- No interference: “We don’t impose our own judgment on how the markets behave. Now, there’s a danger that comes along with success. To avoid this, we try to remember that we know how to build large mathematical models and that’s all we know. We don’t know any economics. We don’t have any insights in the markets. We just don’t interfere with our trading systems.”

- Time: “We’ve been doing this for a very long time. For me, this is my 30th year with the firm. And Jim and others were doing it for a decade before I arrived. This is really important because the markets are complicated and there are a lot of details one has to get straight in order to trade profitably. If you don’t get those details straight, the transaction costs will just eat you alive. So, time and experience really matters.

In Conclusion

Renaissance Technologies, especially its Medallion Fund, is a product of the impactful collaboration between Jim Simons, Elwyn Berlekamp, Bob Mercer, Peter Brown, and of course many others. Their combined expertise in mathematics and finance transformed Renaissance into a powerhouse, revolutionizing investing with a data-driven approach. The Medallion Fund’s exceptional success story is not just about high returns but about the innovative blend of science and finance that set new industry standards.

Dear all,

Here is an update for Medallion Fund.

The performance for Medallion Fund provided in the book is up to 2018.

Pls find below the performance up to 2024 (from public sources) and comparson with Berkshire Hathaway and S&P500.

Regards

James

| Berkshire Hathaway | S&P 500 | Medallion (after fees) | Medallion (before fees) | |

|---|---|---|---|---|

| 1988 | 59.30% | 16.60% | 9.00% | 17.65% |

| 1989 | 84.60% | 31.70% | -4.00% | -2.04% |

| 1990 | -23.10% | -3.10% | 55.00% | 107.84% |

| 1991 | 35.60% | 30.50% | 39.40% | 77.25% |

| 1992 | 29.80% | 7.60% | 33.60% | 65.88% |

| 1993 | 38.90% | 10.10% | 39.10% | 76.67% |

| 1994 | 25.00% | 1.30% | 70.70% | 138.63% |

| 1995 | 57.40% | 37.60% | 38.30% | 75.10% |

| 1996 | 6.50% | 23.00% | 31.50% | 61.76% |

| 1997 | 34.90% | 33.40% | 21.20% | 41.57% |

| 1998 | 52.20% | 28.60% | 41.70% | 81.76% |

| 1999 | -19.90% | 21.00% | 24.50% | 48.04% |

| 2000 | 26.60% | -9.10% | 98.50% | 193.14% |

| 2001 | 6.50% | -11.90% | 33.00% | 64.71% |

| 2002 | -3.80% | -22.10% | 25.80% | 50.59% |

| 2003 | 15.80% | 28.70% | 21.90% | 42.94% |

| 2004 | 4.30% | 10.90% | 24.90% | 48.82% |

| 2005 | 0.80% | 4.90% | 29.50% | 57.84% |

| 2006 | 24.10% | 15.80% | 44.30% | 86.86% |

| 2007 | 28.70% | 5.50% | 73.70% | 144.51% |

| 2008 | -31.80% | -37.00% | 82.40% | 161.57% |

| 2009 | 2.70% | 26.50% | 39.00% | 76.47% |

| 2010 | 21.40% | 15.10% | 29.40% | 57.65% |

| 2011 | -4.70% | 2.10% | 37.00% | 72.55% |

| 2012 | 16.80% | 16.00% | 29.00% | 56.86% |

| 2013 | 32.70% | 32.40% | 46.90% | 91.96% |

| 2014 | 27.00% | 13.70% | 39.20% | 76.86% |

| 2015 | -12.50% | 1.40% | 36.00% | 70.59% |

| 2016 | 23.40% | 12.00% | 35.60% | 69.80% |

| 2017 | 21.90% | 21.80% | 45.00% | 88.24% |

| 2018 | 2.80% | -4.40% | 40.00% | 78.43% |

| 2019 | 11.00% | 31.00% | 39.00% | 76.47% |

| 2020 | 2.40% | 18.40% | 76.00% | 149.02% |

| 2021 | 29.80% | 28.70% | 48.00% | 94.12% |

| 2022 | 4.00% | -18.10% | 19.00% | 37.25% |

| 2023* | 15.80% | 26.30% | 25.00% | 49.02% |

| 2024 | 25.50% | 25.00% | 30.00% | 58.82% |

| 30 years Annualized | 10.73% | 9.74% | 37.58% | 75.66% |

| 20 years Annualized | 10.74% | 10.07% | 39.50% | 76.05% |

| 10 years Annualized | 13.18% | 12.90% | 34.43% | 69.99% |

| 5 years Annualized | 14.43% | 10.72% | 23.40% | 63.57% |

| * 2023 figures for Medallion are estimates |

This is a quote from Jim Simons "Well the system as it is today is extraordinarily elaborate. But it’s not a whole lot of, you know it’s, it’s what’s called machine learning. So you find things that are predictive. You might guess, oh, such and such should be predictive, might be predictive, and you test it out on the computer and maybe it is and maybe it isn’t. You test it out on long-term historical data, and price data, and other things. And then you add to the system, this, if it works and if it doesn’t you throw it out."

This is the only specific (and credible) reference I’ve found to the kind of models Renaissance may have used—at least during their early exploration of machine learning:

“The firm began incorporating higher dimensional kernel regression approaches, which seemed to work best for trending models, or those predicting how long certain investments would keep moving in a trend.”

— Gregory Zuckerman, The Man Who Solved the Market (p. 86)

I doubt this remains their primary method today—if they use it at all—but that’s purely speculative.

I’ve personally used LOESS regression (a form of kernel regression), which performs well but becomes too slow when applied to the number of features typically involved in P123 models. Dimensionality reduction via factor analysis or principal component analysis can help, though it’s still computationally intensive.

More recently, I’ve experimented with using XGBoost to approximate a kernel smoother. Thanks to the recent additions to P123’s AI tools, this kind of nonlinear modeling is now accessible to any member.

When I asked ChatGPT about the idea, here was its summary:

“To use XGBoost to mimic a kernel regression, you can leverage its ability to capture nonlinear relationships by simulating the behavior of a kernel smoother—without explicitly using a kernel function.”

You can ask ChatGPT directly if you’re curious about the technical details. But now that P123 supports both XGBoostand LightGBM, it’s likely we’re already mimicking some of the more advanced methods Renaissance may have evolved toward.

In my opinion, different advanced models often converge on similar outcomes. The real constraint is usually the information content of the data, not the sophistication of the method.

Renaissance almost certainly has access to richer data and superior tools for managing risk—but I’d argue many P123 users are now working with the same general types of modeling techniques, thanks to the P123 AI tools and downloads.

Edit. Later I found this additional method mentioned, included here for completeness. Leonard Baum—co-inventor of the Baum-Welch algorithm—was a cofounder of Renaissance Technologies:

“The Baum-Welch algorithm provided a way to estimate probabilities and parameters within these complex sequences with little more information than the output of the processes. For the baseball game, the Baum-Welch algorithm might enable even someone with no understanding of the sport to guess the game situations that produced the scores. If there was a sudden jump from two runs to five runs, for example, Baum-Welch might suggest the probability that a three-run home run had just been hit rather than a bases-loaded triple. The algorithm would allow someone to infer a sense of the sport’s rules from the distribution of scores, even as the full rules remained hidden.”

— Gregory Zuckerman, The Man Who Solved the Market (p. 47)

However:

If you’re using rolling windows to adapt factor weights, rank systems, or volatility estimates, you’re assuming that recent market behavior contains most of the relevant information for predicting the near future—and that older data becomes less useful or even misleading. That’s essentially a first-order Markov assumption: the future state depends primarily on the current (or most recent) state, not the full history.

This is the same core assumption behind Hidden Markov Models, which underpins the Baum-Welch algorithm.

—

TL;DR: Jargon aside, @Marco has given us the same tools available to RT. What RT does may differ slightly, but I think we’re using the same math—which ultimately leads to the same place, through a variety of algorithms.