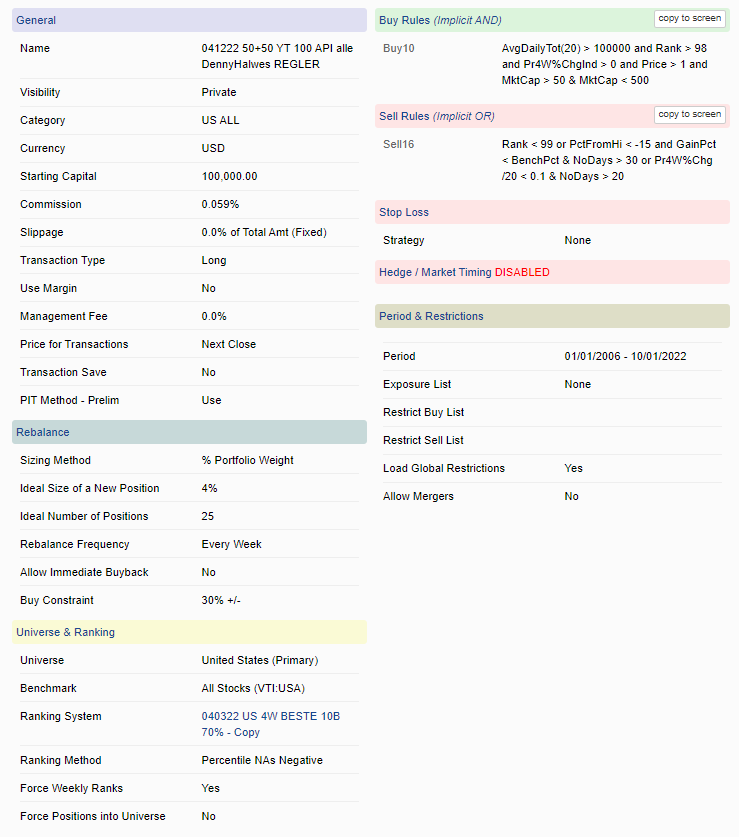

I found that some of Denny’s sell rules in a port which I run using the TF-12 excellent ranking system could be replaced with some much simpler rules that yield >10% better annual return. There’s a 100% increase in turnover as well, but the port only holds 7 stocks.

Old Sell Rules:

Rank < 99 & nodays>20

GainPct< -20

PctFromHi < -15 & Rank < 99.

New Sell Rules

Rank < 99

GainPct< -15

With the new rules:

Annualized Return [color=royalblue]155.06%[/color]

Annual Turnover 688.96%

Max Drawdown -20.21%

The Old Rules:

Annualized Return [color=royalblue]143.56%[/color]

Annual Turnover 585.12%

Max Drawdown -20.09%

(Sim Date: 10/13/01 - 10/14/06)