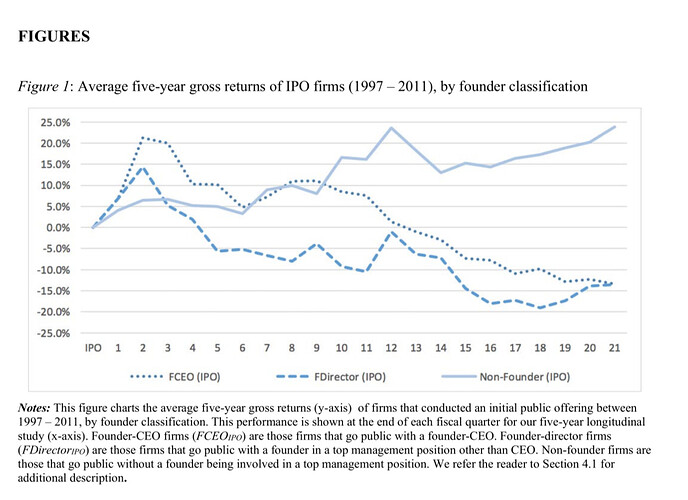

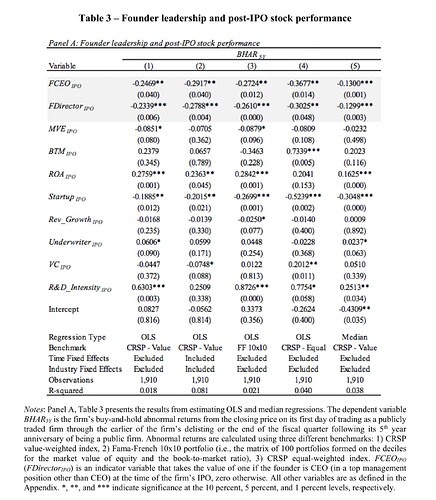

I’m trying to research the returns of Founder led companies: https://anchorcapital.com/founder-led-companies/

I have then looked at the return in BOSS, as well as FIFNX. Which - but with a short history - does not do very well.

But then I have gathered all the shares in a Watchlist: "ADBE, ARE, HES, AFG, ADI, BRK-B, SAM, CPT, COF, GIB, CTAS, CPRT, COMMQ ^ 05, CSGP, CCI, DHI, DHR, DLTR, EQT, EL, EEFT, GRMN, MNST, HOLX, INTU, LEN, LPSN, MAR, MCRI, NBIX, NVDA, PCAR, PENN, PXD, PLUG, REGN, RMD, RH, SGEN, SPG, LUV, STLD, TOL, UNH, OLED, X, WCN, NFLX, BRKR, TGTX, CRM, MKTX, MORN, TDG, BLK, BX, MASI, MELI, BKI, FRC, Z, MN, CPRI, EPAM, FB, TCEHY, NOW, WDAY, RNG, VEEV, WIX, PCTY, MC, ZEN, JD, BABA, W, HUBS, FFWM, ASND, SEDG, GDDY, BPMC, PEN, SQ, TEAM, TWLO, FTV, TTD, BL, SNAP, ARGX, MDB, SE, ZG, SPOT, INSP, TENB, PDD, FTCH, ARCE, NFE, LIFT, ZM, BYND, UBER, RVLV, CRWD, REAL, PHR, TXG, NET, DDOG, BRP, BDTX, DKNG, FOUR, RPRX, PSTX, GOCO, NCNO, XPEV, SNOW, LSF, PRLD, VNT, SEER, DASH, ABNB "

It has done surprisingly well in the shorter and longer period. This also applies if I keep IT out, low volume, and set transaction costs, or have a small or large portfolio.

Has anyone done any research on this phenomenon, and is it possible to achieve excess returns? Or is this another strategy that works on paper but does not work well in the real world?

My idea was to use cloning strategies on either BOSS and FIFNX or both together:

https://quantpedia.com/strategies/alpha-cloning-following-13f-fillings/

https://mebfaber.com/2014/12/31/cloning-the-l...bridgewaters-all-weather/

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2411910

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1566794

https://papers.ssrn.com/sol3/papers.cfm?abstract_id=2741129

https://citeseerx.ist.psu.edu/viewdoc/downloa...amp;rep=rep1&type=pdf

https://www.researchgate.net/publication/3209...ormation_to_all_investors