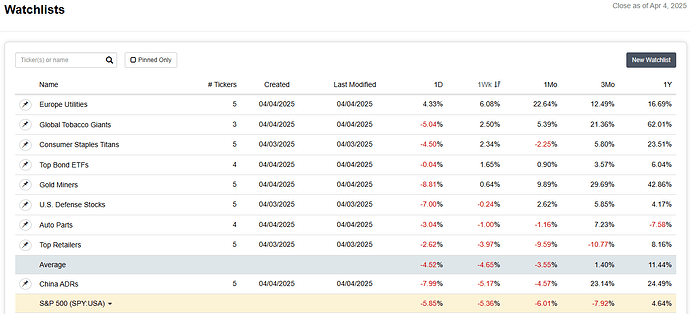

The market's been hit hard lately—Trump's tariff talk has sparked a wave of selling across equities. But not everything went down. A few themes quietly outperformed, and thanks to Watchlists in Portfolio123, I was able to spot them instantly.

If you haven’t used this feature yet, Portfolio123’s watchlists aren’t just static lists of tickers—they’re grouped watchlists that show you the aggregate performance of a set of stocks. You can build themed groups like “Gold Miners,” “Tobacco Giants,” or “Auto Parts,” and the platform calculates returns across 1D, 1W, 1Mo, etc. This makes it a powerful radar for thematic trend spotting.

This Week’s Surprise Winners

I sorted my grouped watchlists by 1-week return to see who’s swimming while everyone else sinks. The S&P 500 dropped -5.36%, but three themes stood out:

1. Europe Utilities: +6.08%

These are a defensive powerhouse in disguise:

- Stable income streams make them attractive in volatile markets.

- Minimal U.S. exposure means tariffs don’t touch them. Their revenues are domestically driven—regulated, predictable, and insulated.

2. Global Tobacco Giants: +2.50%

Another classic defensive group:

- Strong pricing power

- High dividends

- Recession-resistant consumer behavior

3. Gold Miners: +0.64% (but +30% over 3 months!)

They shine when fear rises. This sector has been steadily climbing as investors hedge against uncertainty and inflation.

Watchlists = Trend Spotting at Scale

Grouped watchlists are more than just organization. They let you:

- Detect sector rotation early

- Compare macro themes side-by-side

- Track quant factors (e.g. High ROE, Low P/B)

- Build a factor dashboard that actually shows live performance

Conclusion

Even during a sell-off, smart tools can give you the edge. Grouped watchlists let you track how entire themes are performing in real time, showing you where strength is hiding and helping you stay diversified when everything else is red.

I found that European utilities, global tobacco, and gold miners held up best this week—each offering stability, defensiveness, or insulation from U.S. tariffs.

What other themes are you seeing that worked this week? Any surprising areas of strength that helped diversify your portfolio? Curious to hear what others are tracking.