Okay,

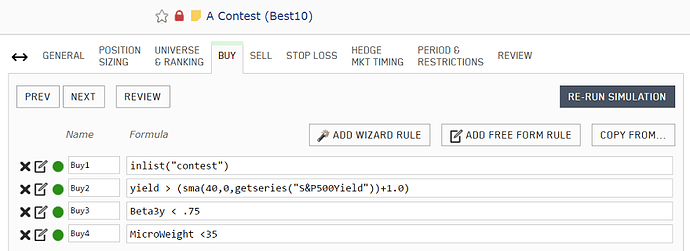

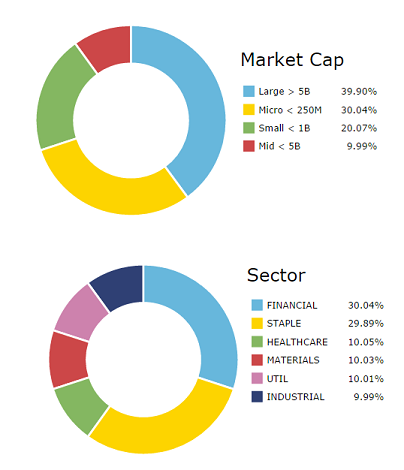

Last list. System creates a list of 500 stocks (using quantitative rules only) to filter out ‘bad companies’. The system them ranks the remaining stocks using quant analysis (mostly value and quality factors from bottom up analysis).

All of these below stats are based on running advanced screener every month, holding for 12 months over the 1999 to 1/2017 period.

This system beat the benchmark 71% of the time and returned a positive amount 81% of the time. Largest 12 month loss was 42% over backtest period.

Here are the summary stats for this system running rolling backtest every month with 1 year hold.

Average 20 18.19% 9.97% 8.21% -41.33% 102.05% 35.28%

Up Markets 165 20 26.50% 18.42% 8.09% -33.13% 113.79% 36.63%

Down Markets 57 20 -5.90% -14.47% 8.58% -65.06% 68.06% 31.36%

Liquidity:

AvgDAilyTot(100)>2000000 and close(0)>2 and MktCap>100

&

Forder(“MktCap”)<2000

So, all stocks should be in the top 2000 of stocks from all fundamental universe in terms of market cap.

Given the nature of this ‘1 year hold’ much of the outcome is due to chance. Having said that -

The list:

1

AHL[5D][1Y]

Aspen Insurance Holdings Ltd 55.00 99.89 FINANCIAL INSURANCE 3,311.60 0.54 55.80 40.34 6.59 4.41 18.69 15.10 21.87 14.67 16.25 5.02 0.24 5.73

2

KEP[5D][1Y]

Korea Electric Power Corp 18.48 99.77 UTIL UTILELECTRIC 23,726.99 0.26 28.37 18.40 -2.27 -4.45 -24.08 -27.67 -28.34 -35.54 -11.66 -22.90 0.69 14.51

3

JBLU[5D][1Y]

JetBlue Airways Corp 22.42 99.66 INDUSTRIAL AIRLINE 7,258.09 0.89 23.67 14.76 9.90 7.72 26.95 23.36 36.21 29.01 2.47 -8.77 4.61 126.62

4

DLX[5D][1Y]

Deluxe Corp 71.61 99.23 INDUSTRIAL SERVICESUPP 3,479.24 1.52 73.42 49.46 4.71 2.53 7.36 3.77 9.34 2.15 35.42 24.18 0.21 6.13

5

RY[5D][1Y]

Royal Bank of Canada 67.71 99.02 FINANCIAL BANKCOMM 100,497.55 1.12 69.70 44.37 3.44 1.26 9.65 6.06 14.57 7.37 29.22 17.98 0.65 18.03

6

ALK[5D][1Y]

Alaska Air Group Inc. 88.73 98.81 INDUSTRIAL AIRLINE 10,937.39 1.00 91.89 54.51 7.08 4.90 32.26 28.66 51.34 44.14 13.18 1.94 1.03 24.66

7

FII[5D][1Y]

Federated Investors Inc. 28.28 98.63 FINANCIAL CAPMARKET 2,892.79 1.75 33.13 22.76 1.47 -0.71 -3.48 -7.07 0.68 -6.52 0.00 -11.24 0.80 25.40

8

RE[5D][1Y]

Everest Re Group Ltd 216.40 98.39 FINANCIAL INSURANCE 8,847.95 0.56 219.51 167.07 2.75 0.57 15.01 11.42 20.45 13.25 19.51 8.27 0.29 6.62

9

JNPR[5D][1Y]

Juniper Networks Inc 28.26 97.47 TECH COMMEQUIP 10,741.63 1.40 29.21 21.17 4.74 2.56 17.41 13.82 28.05 20.85 3.10 -8.14 2.07 94.36

10

ESNT[5D][1Y]

Essent Group Ltd 32.37 97.31 FINANCIAL BANKSNL 3,013.71 1.45 33.94 16.49 3.42 1.24 21.33 17.73 52.69 45.49 50.98 39.74 0.52 13.96

11

LRCX[5D][1Y]

Lam Research Corp 105.73 97.26 TECH SEMIANDEQUIP 17,097.18 1.47 110.35 63.10 7.25 5.07 11.78 8.19 29.11 21.92 36.02 24.78 1.34 53.76

12

CTSH[5D][1Y]

Cognizant Technology Solutions Corp 56.03 97.22 TECH TECHSVCE 33,987.80 1.13 63.43 45.44 3.61 1.43 11.17 7.58 -0.66 -7.85 -3.61 -14.85 3.29 135.61

13

CFR[5D][1Y]

Cullen/Frost Bankers Inc 88.23 96.97 FINANCIAL BANKCOMM 5,548.87 1.32 88.98 42.41 5.61 3.43 23.09 19.50 45.62 38.42 52.44 41.20 0.47 11.08

14

MD[5D][1Y]

Mednax Inc 66.66 96.56 HEALTHCARE HCAREPROVID 6,237.51 0.62 76.96 59.36 1.79 -0.39 1.17 -2.42 -8.26 -15.45 -6.18 -17.42 0.72 14.00

15

VR[5D][1Y]

Validus Holdings Ltd 55.01 96.52 FINANCIAL INSURANCE 4,370.16 0.58 56.41 41.73 0.47 -1.70 10.64 7.05 14.44 7.24 20.64 9.40 0.54 10.71

16

TCB[5D][1Y]

TCF Financial Corp 19.59 96.39 FINANCIAL BANKCOMM 3,348.93 1.14 19.97 10.37 8.83 6.65 36.90 33.31 64.35 57.15 41.34 30.10 1.10 29.09

17

AFL[5D][1Y]

AFLAC Inc 69.60 96.14 FINANCIAL INSURANCE 28,398.26 1.21 74.50 54.57 -1.25 -3.43 -2.75 -6.34 -2.66 -9.85 17.61 6.37 1.53 41.59

18

SYF[5D][1Y]

Synchrony Financial 36.27 96.09 FINANCIAL CONSUMERFIN 29,939.58 1.19 37.31 23.25 3.42 1.24 31.51 27.92 44.39 37.19 21.14 9.90 4.19 155.89

19

JAZZ[5D][1Y]

Jazz Pharmaceuticals Plc 109.03 95.73 HEALTHCARE PHARMA 6,530.02 1.43 160.00 95.80 7.14 4.96 -10.57 -14.16 -21.55 -28.75 -20.57 -31.80 0.59 12.92

20

ICLR[5D][1Y]

Icon PLC 75.20 95.67 HEALTHCARE MEDEQUIP 4,198.27 0.75 85.74 62.31 1.16 -1.02

It’s not a bad list for starting fundamental analysis on - if that’s how you invest (I don’t).

Best,

Tom