Sevensisters,

I have attended a 2 days bootcamp from a 1981 Standford MBA graduate and he is full-time investor cum trader.

His sage advice is stay away from Energy and RealEstate. as these industries are heavily manipulated by supply and demand by many countries. It won’t follow financial data.

Instead of buying stocks; he suggested owning energy company and real estate property if you want to allocate capital on these assets.

Mr.Warran Buffet methodology is value investing. I am immersed and drowned in value investing for many years.

It is for big money and life time investing like 10 years and 20 years horizons.

For individual investor, growth is right way to go.

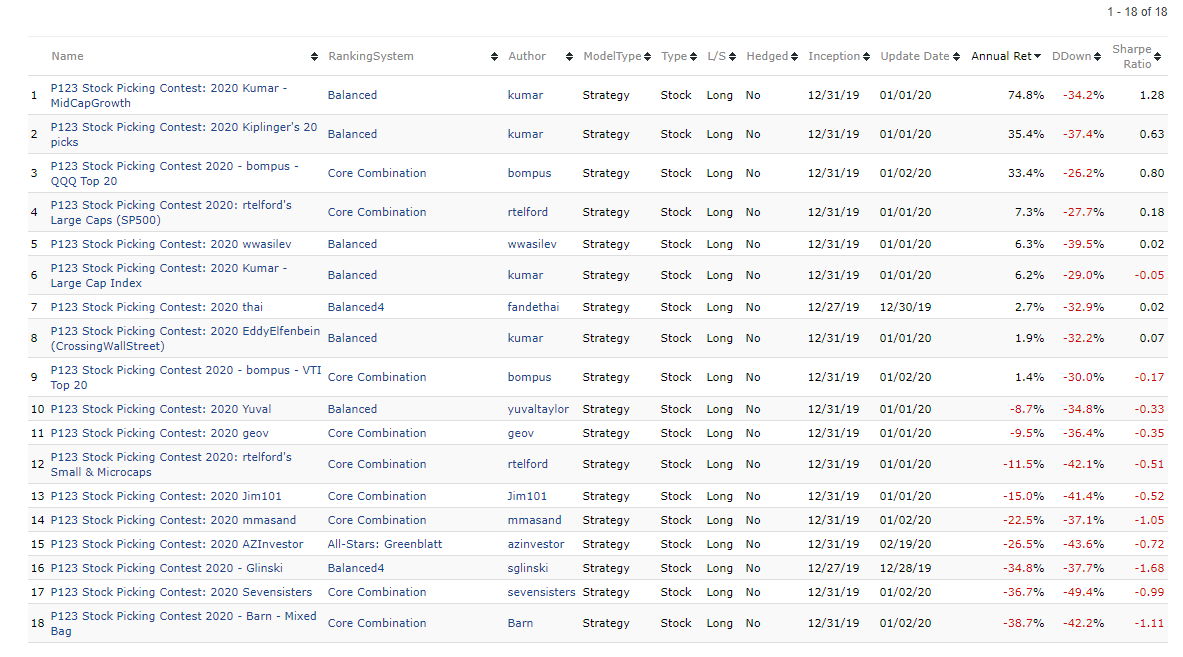

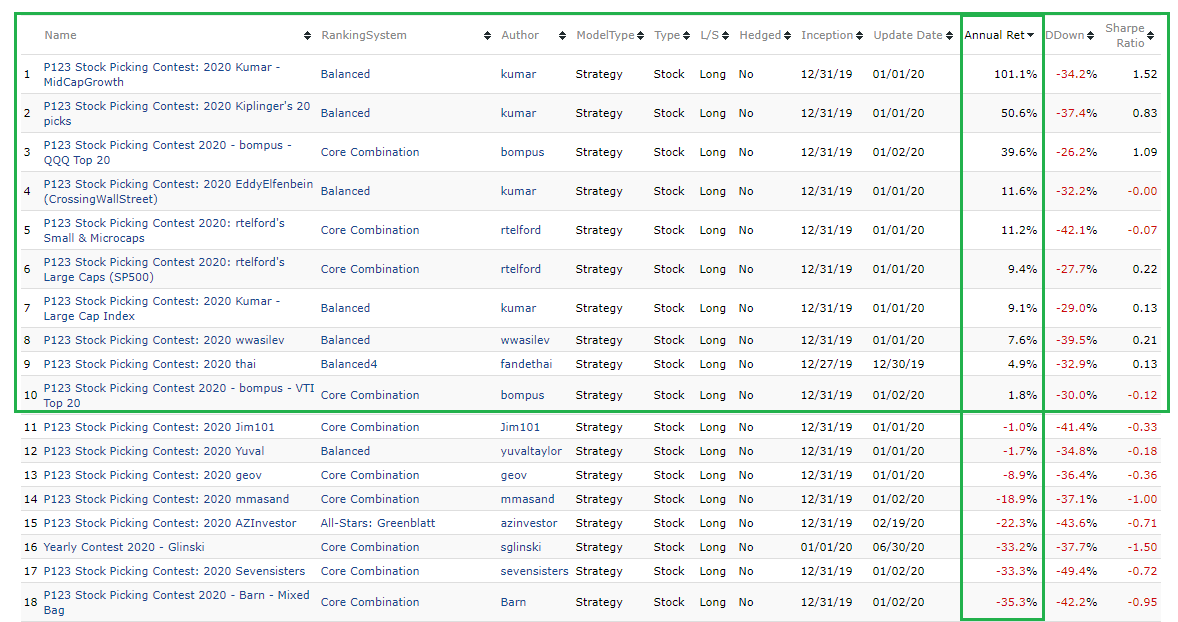

Here, I am attaching for reference, value is buy beaten down stocks. as individual investor i can’t turn the beaten down stocks but Mr.Warran Buffet’s money flow can in 5 to 10 years time.

I don’t have his capital and patience to move the stocks.

====================================

It took me 11 years to understand,

the world’s investment noise to public is opened with

(1) Either Mr.Warran Buffet, Mr.Peter Lynch, etc., kind of investing, buy and hold like forever 10 years and 20 years horizon.

15%- 20% avg return over 20 years time as a world’s greatest investment record for multiple decades without emotion keep investing on good fundamental companies.

(2) Or Day trader/ Weekly trader/ Monthly trader who keep buying and selling without knowing anything just following all the news and following Gurus who are making a living on selling books and giving training for novice investors as day trading experts.

(3) But, the successful secretive investors are living between these 2 extremes without making any noise to the public. 5% to 10% of the elite investors.

I did lot of mistakes like

following Mr. Warren Buffet stocks for few weeks, few months to 1 years holding. It is intended for multiple years.

following day trader ideas for holding multiple months and 1 year and burn down.

One have to define time frame and his stock picking and mindset should be stable as 12 months holdings.

should not get compared and compete with day trader or Mr. Warren Buffet (Life time holdings as buying home/gold ornaments).

It is extremely hard to get rid of old habits and believe on new concepts and build new successful habits; It will take time, even years.

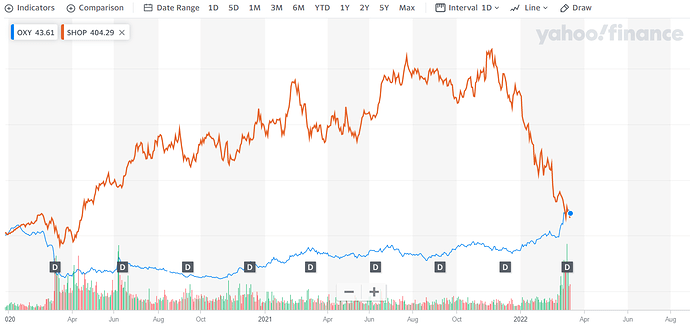

Here, i am attaching 2 screens. By sharing this value stock (OXY) vs growth stock (SHOP),

Hope, I will follow my rules with discipline and emotional control by sharing knowledge to you.

============ Value Investing for last 10 years under performed growth investing by 50% attached IVW Growth and IVE Value Performance chart for reference ==========

OXY will be great performer in 10 years time, if not in 10 years, at least in 20-30 year times,

at worst case, even OXY got bank corrupt; as holding 50+ stocks, it is only 2% of my assets.

at worst case, even OXY got bank corrupt; as holding 50+ stocks, it is only 2% of my assets.

That is value investing and Mr. Warren Buffet ideas.

Never loose money by selling stock on scary environment.

SHOP is growth investing. best performing sector Technology, best performing industry Software. SHOP - Online shopping. in current environment work from home and stay at home.

This growth stocks even looks attractive. Growth Story strengthen Growth Stocks further.

SHOP is my top performing pick for this 20 stocks pick competition for this year year 2020.

Growth idea is 180 degree paradigm shift in thinking process.

Warren Buffett — ‘Risk comes from not knowing what you’re doing’

It is applicable to me as well. I love to buy 52 weeks low and scare to buy 52 weeks high.

I am working on change my thinking process and attitude and go along and become comfortable to buy 52 weeks high and become successful growth investor.

All of my designer models are value based. I believed in value (Buy low and Sell High). but end up with Buying Low and Selling at Extremely Low as OXY chart.

while 2017, 2019 and 2020 my stocks picks are growth based manual picks. it performed better than most of the bench marks.

In 2018, i went with old habits picking bouncing stocks from 52 weeks low with good fundamentals and technicals. it performed worst than bench mark.

Writing journal is one of the best way to learn by one’s mistakes and one’s success.

As I am learning from your OXY energy stock experience.

I believe, my experience will helps you and others to learn as well.

YuvalTaylor ideas of this yearly stock picking competition makes me better investor over last 4 years period and stay aligning with 1 year sweet spot holdings.

Sorry, accidentally, i have attached the charts twice.

Thanks,

Kumar

![]()