Actually, I’m fine with being called out, questioned or challenged . . . and even flamed if anyone is into that. People who can’t take that sort of heat need to stay the he** out of the kitchen.

As many of you know, it is my belief that investing is not the same thing as passing a statistics test, so I’ll talk in market terms and not use lingo like out of sample.

Let’s go down the list:

- Cherrypicking the Blue Chips - 2 variations

Great successful model that aged(no strategy is forever, anyone who thinks so contact me off line so i can sell you a stake in a NYC bridge that connects Manhattan and Brooklyn). Whether it really reached the end of the line or not is something that can best be judged after the great value inversion (Factor Inversion: When Up Is Down, Good Is Bad, Dumb Is Smart, and Right Is Wrong – Acti-quant) resolves once and for all.

- Low Volatility Select

Good model. Looks like it still is. Bear in mind it was never designed to beat SPY in a foot race. The idea was to get decent SPY-lke returns with less volatility. Thus far, the market has been largely volatility friendly during the model’s life so those who made this return-risk choice are not taking bows. But unlike academic studies, the market is something that has no end date. Looking ahead, I’m still fine with it.

- Underestimated Blue Chips

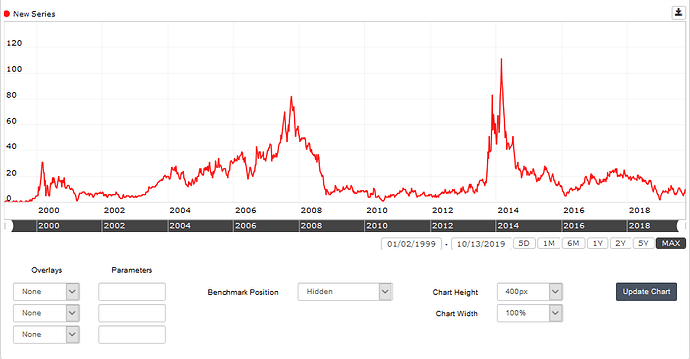

I love it, love it, and love it some more. It was my effort to translate an intriguing theoretical concept (noise vs. value) into an implementable dollars-and-cents strategy. And educationally, its a great case study in analyzing any model on statistical basis because, again, there never is an end date. Prof. F (Father) Time has given more failing grades to academic papers than anyone. As you can see, this looked like a piece of sh** for a long time but then, pumped the gas and ironically, was a value model that took off in the face of the value inversion.

- Sweet Spot Equity Income

I owned it since day one and never regretted it. Better yield than DVY and comparable or better price performance. No complaints from this investor.

Those are the models that are really and truly mine. The rest were command models, things I did on request to seed Designer Models back on Day 1.

- Small Cap GARP

Did better than I thought it would. Looked really good even at a time when small wasn’t hot, but lately fell prey to the great value inversion. For this to improve, we’ll need to see the inversion resolve and/or the market go back to rewarding the sort of risk inherent in small caps. I’m guessing the former may happen sooner than the latter.

- Buffett

Z-z-z-z-z-z. I’ve always been on the fence about guru models, especially when they reference gurus that never did quant. This one was meh for a while, and sub-meh when the value inversion hit. My opinion: If you’re really into Buffett, just buy BRK.

- Piotroski

Because Piotroski’s landmark paper made such great educational points, I always wanted the strategy to work. But Bridging the gap between academia (and its deciles and static factor choices) and do-ability just didn’t happen. Piortoski pinned value based on PB and that put the strategy behind the 8-ball from day one. If I were to do a Gerstein PB strategy, I’d create an intelligent factor. If you want a hint, look in the strategy design course for my writings on warranted valuation ratios. Add in the recent value inversion and we really do have a model that looks fit mainly for the SNH (Strategy Nursing Home).

- Chaikin With Market Timing

Probably not a good idea to have ever included this since, due to intellectual property considerations, I was just fiddling with market timing and isolated Chaikin factors and necessarily excluded the core of what his work involves, a 4-category 20-factor model (created on p123) known as Power Gauge. And it’s not Power Gauge only; it’s a full set of protocols that combine Power Gauge with other technical factors that can be read visually and/or numerically. I work with Chaikin Analytics now (I’m no longer full time p123) and know the approach quite well; that wasn’t so back when that strategy was created. But despite all these handicaps, it actually outperformed until early this year and I suspect that may have much to do with its use of an R2000 universe, and as we know IWM has stunk lately viz SPY. So factoring that in, the Chaikin indicators were good enough to offset my then-sub-expert understanding of how to use them. Looking ahead, it probably depends on if/when the market will gains be willing to reward the extra risks associated with smaller companies. I’m not holding my breath waiting.